crypto coins graphics Visual Impact in Cryptocurrency

In today's digital landscape, crypto coins graphics play a crucial role in shaping perceptions and influencing market trends. The visuals associated with cryptocurrency are not just aesthetic; they are instrumental in conveying brand identity and fostering investor confidence. Understanding their evolution and significance can provide valuable insights into the crypto market's dynamics.

The variety of graphics used in the crypto space, from logos to infographics, has evolved significantly, impacting how projects are viewed by potential investors. As we dive deeper into the realm of crypto graphics, we'll explore essential tools, design principles, and the latest trends that are influencing this vibrant field.

Introduction to Crypto Coins Graphics

In the fast-paced world of cryptocurrency, visuals play a crucial role in shaping investor perception and market trends. The significance of graphics in the crypto coin market goes beyond mere aesthetics; they serve as vital tools for communication, branding, and information dissemination. As the market has evolved, so too have the graphics used to represent these digital assets, adapting to the needs of a more discerning audience.The evolution of graphics in the cryptocurrency space has witnessed a shift from simplistic designs to more sophisticated and engaging visuals.

Early crypto projects often relied on basic logos and charts, but as the industry matured, the demand for high-quality graphics increased. Today, well-designed visuals can enhance a project's credibility and appeal, influencing investor behavior and market dynamics.

Types of Crypto Coins Graphics

Various types of graphics are essential in the cryptocurrency sector, each serving distinct purposes. Understanding these graphics can help to appreciate their impact better.

- Logos: The visual identity of a cryptocurrency, logos are often the first point of interaction for investors. A memorable logo can enhance brand recognition.

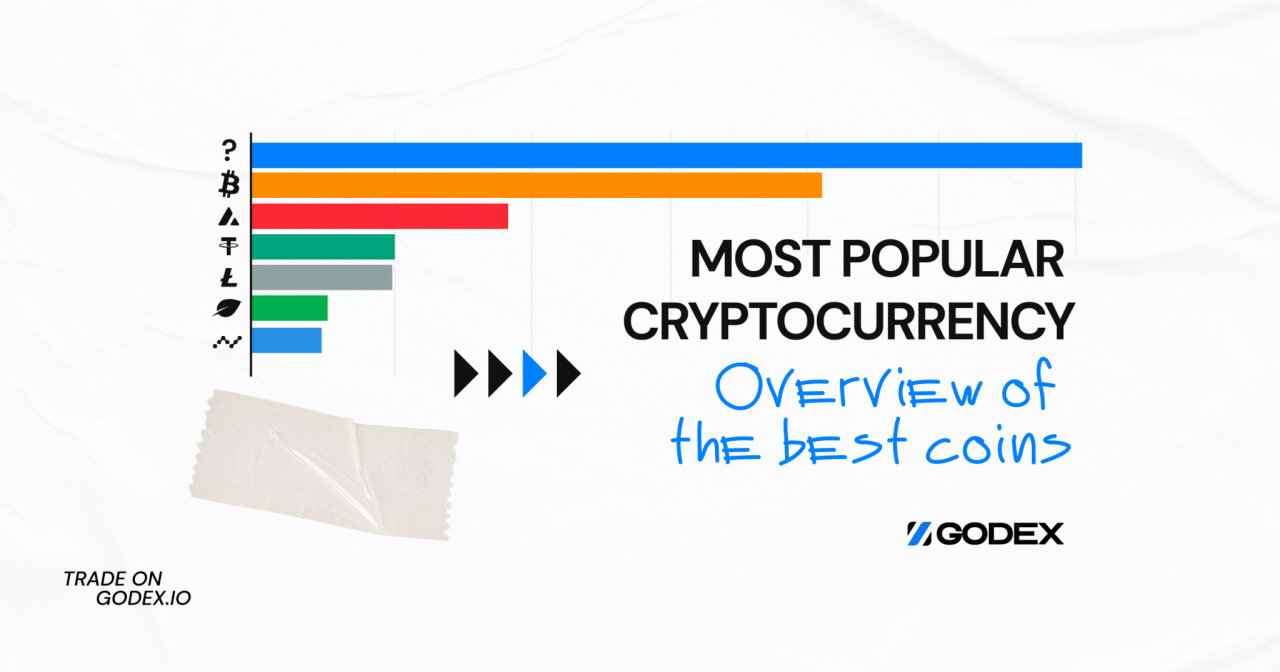

- Infographics: These combine data and design to present complex information in an accessible format. They are particularly effective in explaining technology or market trends.

- Charts: Visual representations of data trends, such as price movements or market capitalization, help investors make informed decisions.

Prominent examples include Bitcoin's simple yet iconic logo, Ethereum's distinctive symbol, and informative infographics from BitDegree that explain blockchain technology.Effective crypto graphics design combines clarity, relevance, and appeal. Key characteristics include simplicity, scalability, and the ability to convey a message or story quickly.

Tools and Software for Creating Crypto Graphics

Creating compelling graphics requires the right tools. A wide range of graphic design software is available, catering to both professionals and beginners in the cryptocurrency space.

- Adobe Illustrator: A powerful vector graphics editor known for its versatility and professional features, making it ideal for logo design and intricate graphics.

- Canva: A user-friendly design tool perfect for non-designers, offering templates and a straightforward interface for creating infographics and social media posts.

- Figma: A collaborative design tool that allows multiple users to work on graphics in real-time, great for teams focused on branding.

Each tool has unique features that cater to different design needs. For instance, Adobe Illustrator offers precision and control, while Canva provides ease of use for quick creations.

| Software | Pros | Cons |

|---|---|---|

| Adobe Illustrator | High customization, professional quality | Steep learning curve, subscription cost |

| Canva | User-friendly, quick templates | Limited customization, not as versatile |

| Figma | Real-time collaboration, cloud-based | Requires internet, may have performance issues with large files |

Best Practices for Designing Crypto Coin Graphics

When designing crypto graphics, adhering to essential design principles is vital for effectiveness and clarity. These principles ensure that graphics resonate with the target audience and enhance the overall brand message.

- Consistency: Maintain a uniform style across all graphics to reinforce brand identity.

- Clarity: Avoid clutter; ensure that the message is easy to understand at a glance.

- Color Theory: Use colors that evoke the desired emotional responses while aligning with brand values.

A checklist for effective graphics should include elements like logo placement, color palette consistency, typography choice, and clear call-to-action elements. Understanding how color theory applies specifically to cryptocurrency graphics can significantly impact perception. For instance, blue often conveys trust, making it a popular choice for financial-related projects.

The Role of Branding in Crypto Coin Graphics

Branding significantly influences the design of crypto graphics, shaping how a project is perceived by the public and investors. Effective branding aligns graphics with the project's identity and core values.Successful branding case studies in the crypto space illustrate the power of cohesive graphic design. Projects like Chainlink have established recognizable identities through consistent visual elements that resonate with their target audience.

Aligned graphics can enhance trust and emotional connection, leading to increased investor loyalty.

Innovations in Crypto Graphics Technology

Emerging technologies are continuously shaping the future of crypto graphics. Innovations such as augmented reality (AR) and virtual reality (VR) are being explored to create immersive experiences that engage users beyond traditional visuals.Blockchain technology is also influencing graphic design, enabling transparent and decentralized verification of design ownership and authenticity. Some projects are already utilizing these technologies to develop unique and engaging graphic content that stands out in a competitive market.

Analyzing Trends in Crypto Coin Graphics

Current trends in crypto graphics reflect the evolving landscape of the cryptocurrency market. Some notable trends include the use of vibrant colors, minimalist designs, and animated elements that capture attention.Social media plays a crucial role in influencing graphic design within the cryptocurrency space. Platforms like Twitter and Instagram emphasize the need for eye-catching visuals to drive engagement and shareability.

| Trend | Application in Crypto |

|---|---|

| Vibrant Colors | Attract attention and convey energy in promotional materials |

| Minimalist Design | Enhances clarity and focus on key messages |

| Animated Graphics | Engages users, making content more dynamic |

Case Studies of Successful Crypto Graphics

Examining successful crypto projects and their graphic designs reveals key elements that contribute to their effectiveness. Projects like Binance and Coinbase have effectively utilized clean, recognizable graphics that communicate professionalism and trust.Key elements contributing to these graphics' success include strong branding, clarity of message, and visual appeal. Lessons learned from these cases emphasize the importance of consistency, user engagement, and adaptability in design.

- Strong branding leads to higher recognition.

- Clarity in messaging is crucial for user understanding.

- Visual appeal enhances engagement and interest.

The Future of Crypto Coins Graphics

Predictions for the evolution of graphics in the cryptocurrency market suggest an increasing integration of advanced technologies and design principles. As the market matures, graphic designers will face both challenges and opportunities in creating compelling visuals.Potential challenges include keeping pace with rapid technological advancements and maintaining consistency in branding as the industry diversifies. Conversely, opportunities lie in leveraging innovative tools to enhance graphic interactivity and user engagement.Skills that will be in demand for future crypto graphics creation include proficiency in motion graphics, understanding of AR/VR design principles, and the ability to create responsive designs that cater to various platforms and devices.

Outcome Summary

As we wrap up our exploration of crypto coins graphics, it's clear that effective visual communication is paramount in the cryptocurrency market. The interplay between design and branding not only captures attention but also builds trust and engagement within the community. Looking ahead, the future of crypto graphics holds exciting possibilities fueled by innovation and creativity, making it a thrilling space to watch.

User Queries

What are crypto coins graphics?

Crypto coins graphics refer to visual elements used in the branding and communication of cryptocurrency projects, including logos, infographics, and charts.

Why are graphics important for crypto coins?

Graphics enhance investor perception, convey brand identity, and can significantly influence market trends and engagement.

What tools are commonly used for creating crypto graphics?

Popular tools include Adobe Illustrator, Canva, and Figma, each offering features suited for graphic design in the cryptocurrency space.

How do design trends affect crypto graphics?

Design trends can shape the aesthetic choices made by crypto projects, affecting how they resonate with their target audience and the overall market perception.

What skills are needed for future crypto graphics creation?

Skills in graphic design, understanding of branding, and familiarity with emerging technologies like AR and VR will be increasingly important for future designers.